OVERVIEW OF

PERFORMANCE IN THE YEAR

Grupo Herdez generated record consolidated net sales and EBITDA figures in 2015. This was the combined effect of inorganic growth resulting from the acquisition of the assets of Helados Nestlé® in Mexico and exceptional commercial execution in a challenging environment.

In Mexico core, the results were driven by a recovery in the consumption environment, positive results from the execution of commercial initiatives and benefits derived from projects aimed at improving manufacturing efficiencies, which helped offset the impact of a stronger US dollar towards the end of the year.

In the Frozen division, the acquisition of Helados Nestlé® in March doubled the size of the business, positioning the Group

as the second leading player in the category in Mexico. At Nutrisa®, the integration into Grupo Herdez began at the end of the year. These factor, combined with weaker than expected performance of the commercial portfolio, resulted in a decline of the EBITDA margin.

At MegaMex, whose results are registered in the Equity Investment in Associates line, the increase in earnings reflected the benefit of a stronger US dollar, which offset restructuring expenses and inventory adjustments experienced during the year.

Net Sales

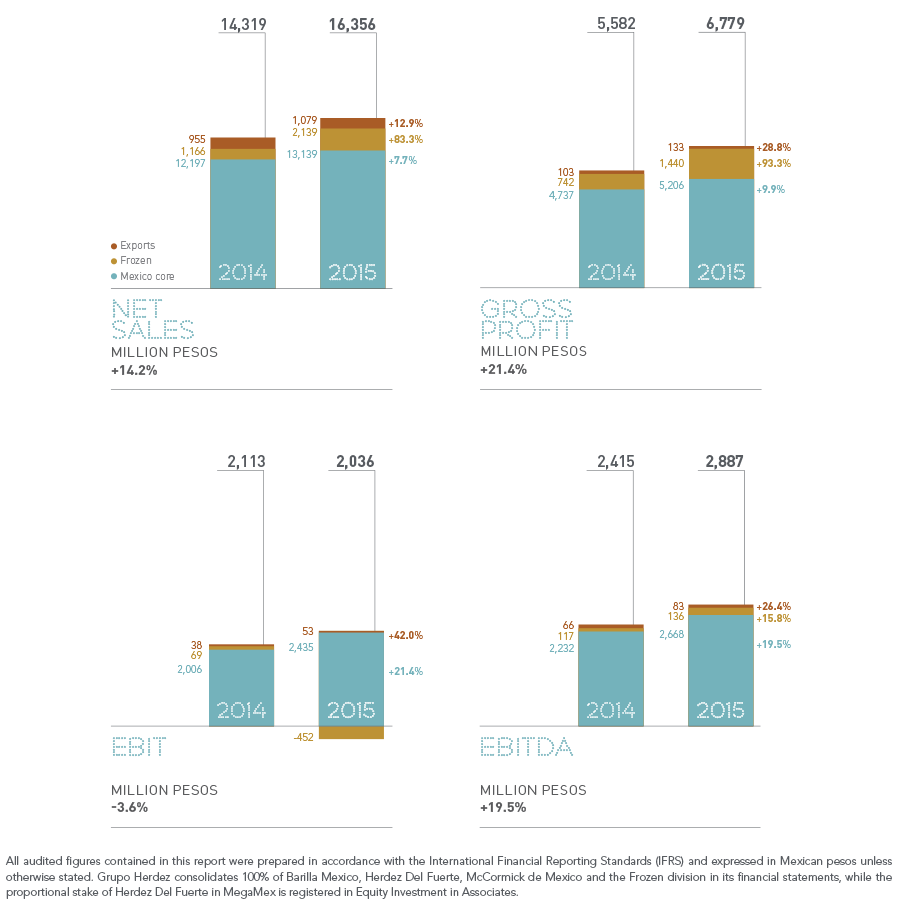

Consolidated net sales totaled Ps. 16,356 million in 2015, a 14.2% rise from the 2014 figure. In Mexico core,sales rose 7.7% to Ps. 13,139 million, benefiting from a balanced combination of pricing and volume growth, with commercial execution, innovation, advertising campaigns and manufacturing efficiencies driving double digit growth rates in home-style salsas, hot sauces, jams, mole, teas and tomato purée.

The Frozen division grew 83.3% to Ps. 2,139 million due to the incorporation of Helados Nestlé®, as the performance of the commercial portfolio at Nutrisa® continued to report declines compared to 2014.

However the improvement in consumption, coupled with more targeted initiatives, helped drive positive traffic growth.

Export sales rose 12.9% to Ps. 1,079 million primarily due to the benefit of a stronger US dollar.

Gross Profit

Consolidated gross margin in the year was 41.4%, 2.4 percentage points higher than in 2014. This was primarily the result of: i) lower manufacturing costs resulting from a full year of operations of the new mayonnaise plant and the consolidation of the vegetables plant in Sinaloa; ii) a better sales mix in Mexico core and Nutrisa®; and iii) risk management. Combined, these factors limited the adverse impact of the stronger US dollar in the second half of the year.

Sales, General and AdministrativeExpenses (SG&A)

SG&A as a percentage of net sales was 26.2%, an increase of 2.5 percentage points over the 2014 figure, due to the incorporation of the higher expense structure of Helados Nestlé®, the opening of 58 net new Nutrisa® stores, Ps. 65 million of integration-related expenses in the Frozen division, and year-end accruals recognition.

Earnings Before Other Income and Expenses (EBIT Before Other Income and Expenses)

EBIT Before Other Income and Expenses totaled Ps. 2,488 million, while the margin remained flat at

15.2%.

Other Income & Expenses

The Company registered a non-cash impairment charge of Ps. 450 million in the Frozen segment in the fourth quarter of the year related to the recognition of a loss in the value of the goodwill of Nutrisa®, in accordance with the application of the International Accounting Standard (IAS) 36 “Impairment of assets.”

Earnings Before Interest and Taxes (EBIT)

Consolidated EBIT decreased 3.6% to Ps. 2,036 million, with a margin of 12.4%. Excluding the aforementioned impairment charge, consolidated EBIT would have been Ps. 2,486 million, 17.7% higher than in 2014, while the margin would have expanded 40 basis points to 15.2%.

Comprehensive Financial Result

The Company registered a net financing cost of Ps. 463 million in 2015, 79.2% higher than in 2014 due to a currency loss of Ps. 89 million.

Equity Investment in Associates

Equity investment in associates rose 7.7% to Ps. 446 million.This reflected the benefit of a stronger US dollar, offset by the restructuring of Don Miguel and inventory adjustments during the year.

Consolidated Net Income

Consolidated net income declined 14.1% to Ps. 1,293 million, with a margin of 7.9%. Excluding the aforementioned impairment, consolidated net income for the year would have been Ps. 1,743 million, 15.8% higher when compared to 2014, with a margin of 10.7% due to solid results at Mexico core.

Majority Net Income

Majority net income was Ps. 389 million, with 3.0 percentage point contraction in the margin to 2.4%; excluding the impairment, majority net income would have been Ps. 839 million, 8.8% higher than in 2014.

Earnings Before Interest, Taxes, Depreciation,Amortization and other non-cash items (EBITDA)

EBITDA totaled Ps. 2,887 million, while the margin was 17.7%, 80 basis points higher than in the same period of last year. It should be noted that since the impairment charge was treated as an accelerated goodwill amortization of Nutrisa®, it was restated to the EBITDA figure.

Capital Expenditures (CAPEX)

Net CAPEX in the year was Ps. 1,039 million. The majority of these funds were allocated to the new tuna vessel, ongoing expansion of the distribution center in Sinaloa, and new freezers and stores for Helados Nestlé® and Nutrisa®, respectively.

Cash Flow from Operations

Cash flow from operations totaled Ps.1,861 million in 2015.

Financial Structure

At December 31, 2015, the Company’s consolidated cash position totaled Ps.1,483 million while interest-bearing liabilities, excluding corporate debt, was Ps. 5,960 million. Corporate debt includes interest-bearing liabilities of the associated company Herdez Del Fuerte that cannot be eliminated since its results are fully consolidated into Grupo Herdez financial statements. It is important to note

that in the Consolidated Statement of Financial Position, Grupo Herdez recognizes an account receivable for the same amount.

Net debt to consolidated EBITDA was 1.6 times compared to the 1.4 times registered in 2014, while net debt to consolidated stockholders’ equity was 0.32 times.

Nutrisa® Stores

Nutrisa® added 58 net stores in 2015, for a total of 487 stores at year end.